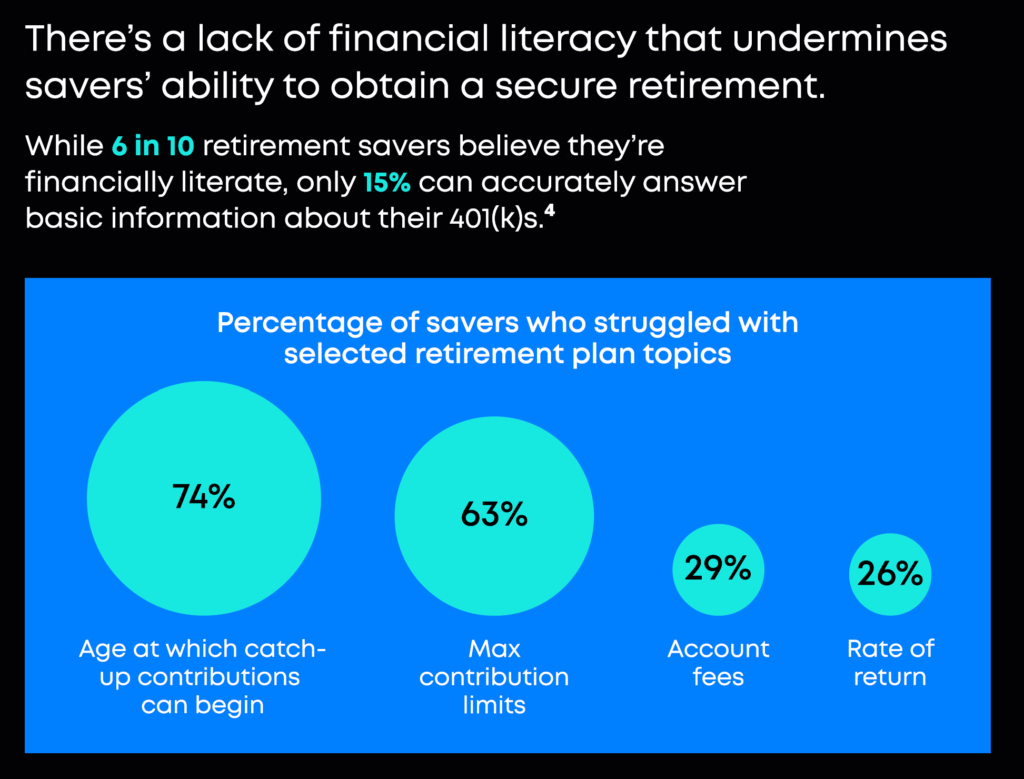

For many employees, navigating a 401(k) or 403(b) plan can feel overwhelming. Once enrolled, employees often have no one to turn to for guidance on how much to contribute, which investment options to choose, or how to manage their accounts over time. Without professional advice, employees may struggle to stay on top of their savings strategy, properly assess risk exposure, or make informed decisions during market downturns. When headlines report economic uncertainty, it’s easy to panic, but having an advisor can help employees remain calm and make strategic choices that align with long-term financial goals.

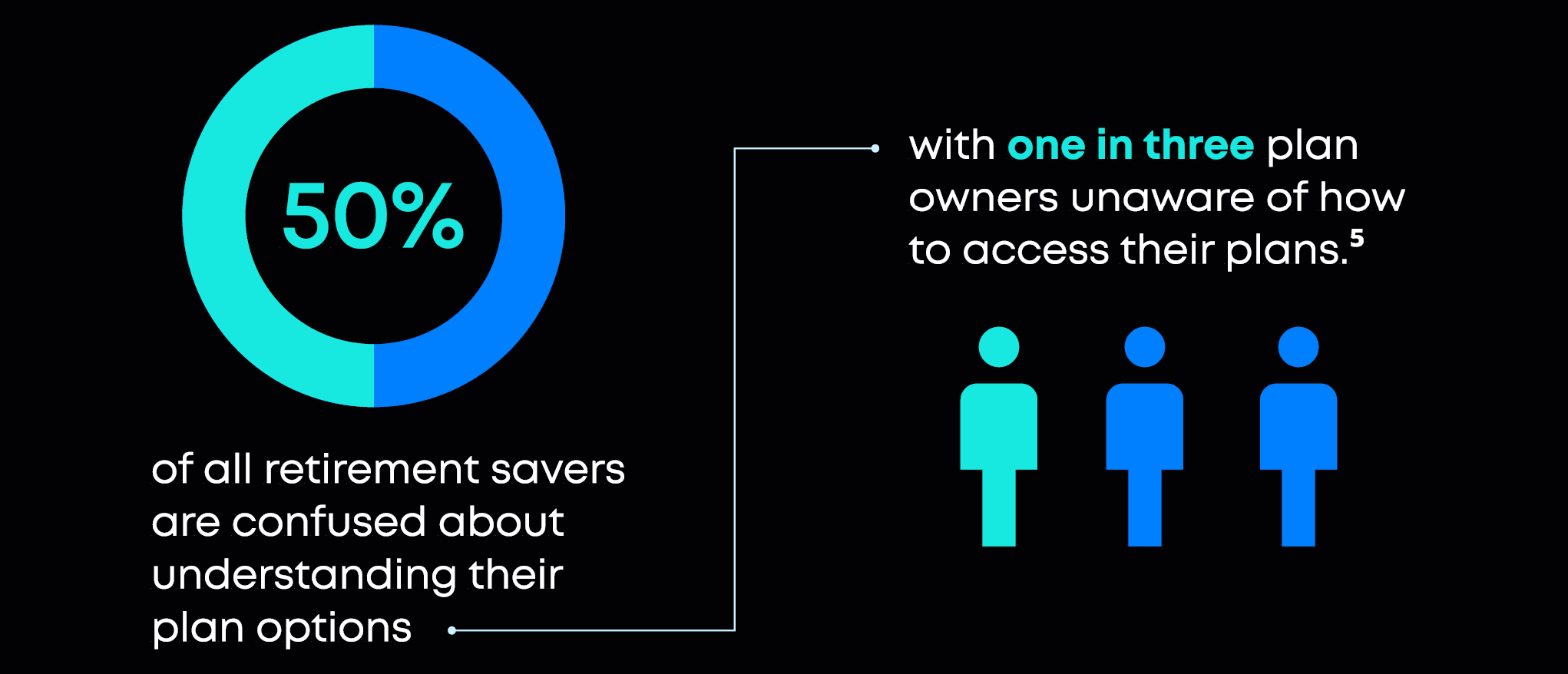

Employers and plan providers typically avoid giving specific investment advice to employees due to fiduciary liability concerns. While employers may offer access to various funds, and carriers may provide general education on available options, the final decision is left entirely to the employee. This hands-off approach can leave employees feeling lost, increasing the risk of poor investment choices or missed opportunities for growth. With the help of a financial advisor, employees can make confident, informed decisions and maximize their retirement savings potential.

Key Reasons to Work with an Advisor:

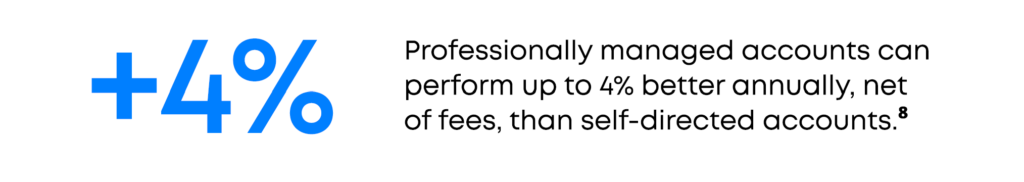

- Higher Returns: Professionally managed accounts generate 3-4% higher annual returns compared to self-managed accounts.

- Simplified Decision-Making: Skip deciphering lengthy plan documents—let an expert handle it.

- Comprehensive Financial Strategy: Align your retirement plan with the rest of your investment portfolio for optimal results.

- Proactive Risk Management: Advisors can rebalance your portfolio during market volatility to keep you on track.

- Security & Peace of Mind: Your advisor can manage your retirement savings securely through platforms like Pontera without accessing your account credentials.

Achieve Your Retirement Goals

Maximize your hard-earned savings with professional management. Studies show that professionally managed accounts generate 3-4% higher returns per year, net of fees, compared to self-managed accounts. By connecting your 401(k) or 403(b) to platforms like Pontera, you enable your financial advisor to provide personalized guidance and optimize your retirement strategy.

Conquer Information Overload

Managing investments and making informed financial decisions requires time, skill, and effort. Your financial advisor can now oversee your 401(k) as part of your entire portfolio, eliminating the need for you to decipher complex plan information and fund options on your own.

Unlock Your Saving Potential

Pontera enables your advisor to manage all your financial accounts holistically, including your 401(k) or 403(b). This comprehensive approach allows for better asset allocation and tax strategies, maximizing your saving potential.

Achieve Financial Wellness

Life is full of unexpected changes. Working with a financial advisor helps you make better decisions during uncertain times, your advisor can proactively rebalance your accounts during market volatility, potentially making the difference between meeting your retirement goals or falling short.

Get Peace of Mind

Pontera prioritizes your financial wellbeing and security. The platform allows advisors to manage retirement accounts without direct access or shared credentials. Modern platforms use advanced cybersecurity and data protection technologies to safeguard your financial information. Take control of your retirement future today. Request our free brochure to learn more about how professional 401(k) and 403(b) management can benefit you.

Take Action Now:

Download your full Pontera brochure here >>

Fill out the form below, and a professional will contact you to discuss how we can help optimize your retirement savings.

- Name:

- Email:

- Phone:

- Current 401(k) or 403(b) provider:

- Estimated account balance:

[Submit]

By submitting this form, you agree to be contacted by one of our retirement specialists to discuss your 401(k) or 403(b) management options.

Pictures and Research Courtesy of Pontera.