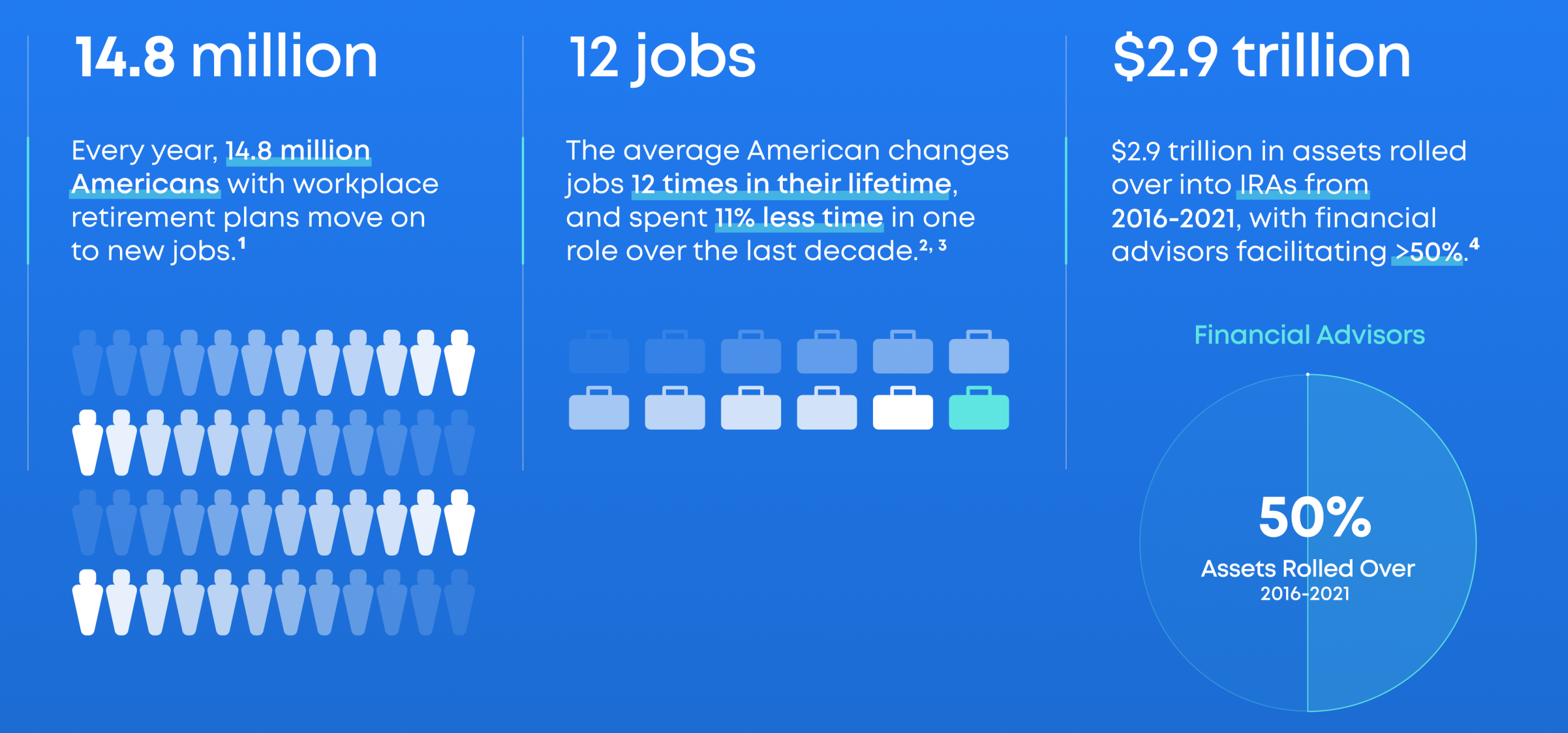

With 14.8 million employees moving jobs while holding retirement accounts, rollovers are a major financial decision. On average, an individual changes jobs 12 times during their career, contributing to the $2.9 trillion moved from employer-sponsored retirement plans to IRAs. However, new developments allow employees to keep their 401(k) or 403(b) plans with their former employer if the plan offers strong benefits, high-quality fund selection, and cost-effective investment management. Before making a decision, it is essential to understand the pros and cons of rolling over your retirement savings.

Pros of Rolling Over Your 401(k) or 403(b) Plan

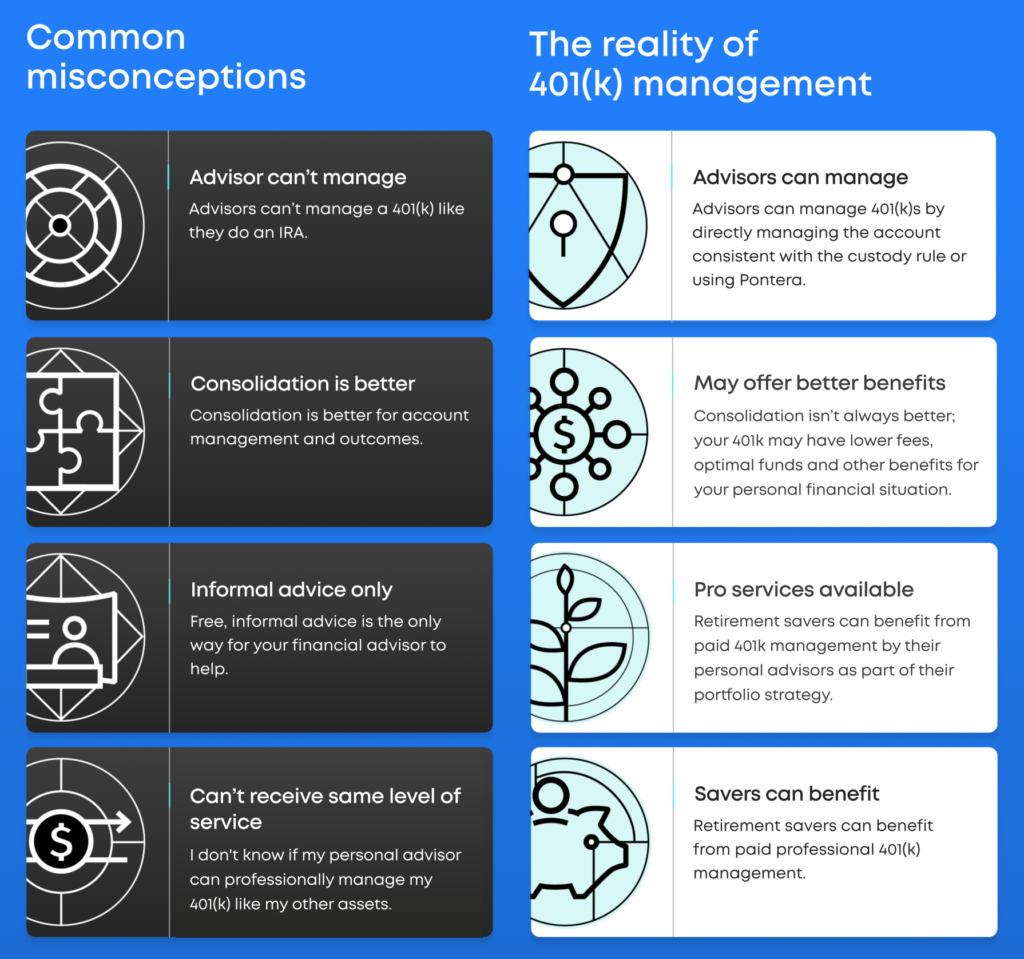

- Consolidation & Simplification – Merging multiple accounts into a single IRA simplifies tracking and managing investments.

- Greater Control – With an IRA, you gain flexibility over investment choices and withdrawal strategies.

- More Investment Options – IRAs typically provide a broader range of investments compared to employer-sponsored plans.

Cons of Rolling Over Your 401(k) or 403(b) Plan

- Loss of Employer-Specific Benefits – Some employer plans offer unique investment opportunities or lower-cost institutional funds.

- Potential Tax Consequences – Mishandling the rollover process can lead to taxes and penalties.

- Better Creditor Protection in a 401(k) – Employer-sponsored plans generally provide stronger legal protection from creditors compared to IRAs.

- Loss of Employer Matching Contributions – If still employed, rolling over too soon may forfeit future employer contributions.

New Developments: Keeping Your Plan with Your Employer

Recent changes in the industry allow employees to keep their 401(k) or 403(b) plans with their employer even after leaving their job. If the plan is well-structured, it can be a cost-effective way to maintain investment exposure to quality funds while a professional continues managing the account. Employees should assess their employer’s plan, including investment choices, fees, and administrative support, before deciding to roll over.

Consult a Professional for the Best Decision

Making the right choice depends on your unique financial situation. Consulting with a Certified Financial Planner (CFP) or advisor ensures you select the best option for your retirement savings. A professional can evaluate your current employer’s plan, compare IRA alternatives, and guide you in making the most informed decision.

Take Control of Your Retirement Future

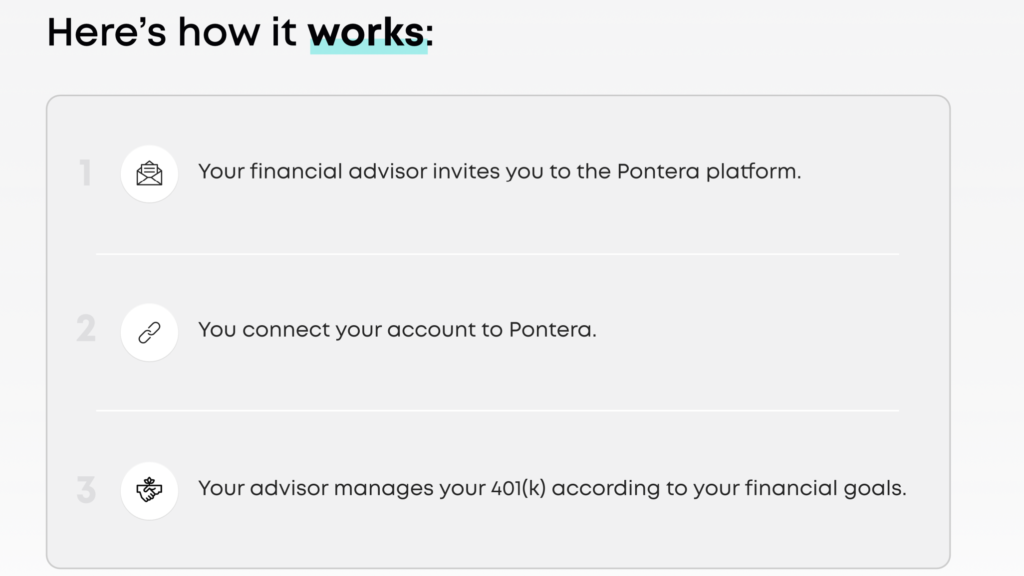

Don’t navigate this decision alone. Download free Pontera brochure >>

and connect with a qualified financial advisor.

Fill out the registration form to get personalized guidance on managing your retirement savings effectively.