The United States has experienced a dramatic shift in how Americans save for retirement. This transformation is reflected in the rise of defined contribution plans, like 401(k)s, and the decline of traditional pensions, also known as defined benefit plans.

The Rise of the 401(k) Plan

Initially introduced as a supplement to other employee benefits, the 401(k) has become the most common private employer-sponsored retirement program in the U.S. Unlike traditional pensions, which guarantee a specific monthly income for life, 401(k)s transfer the responsibility and risk of saving for retirement to employees. This shift has fundamentally changed how Americans plan for their financial futures.

Key Milestones in 401(k) History:

- 1978: The 401(k) was created as part of the Revenue Act, allowing employees to defer income taxes on retirement savings.

- 1980s: Employers began widely adopting 401(k) plans as a cost-effective alternative to pensions.

- 2000s: The popularity of 401(k)s surged, with millions of Americans using these plans as their primary retirement savings vehicle.

Comparing Defined Benefit ( like old school Pension plans ) and Defined Contribution Plans ( like 401k, 403b … )

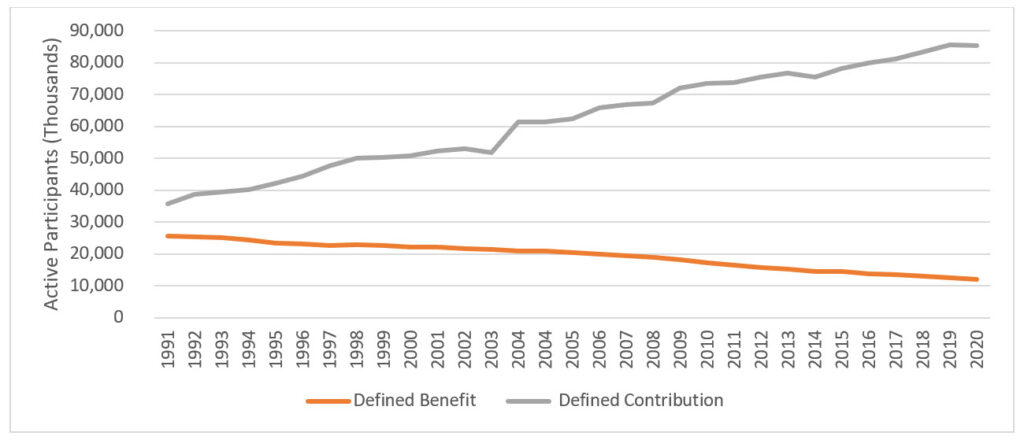

Over the last few decades, there has been a noticeable decline in defined benefit plans and a corresponding increase in defined contribution plans. This trend is illustrated in the chart below, which shows the number of Americans participating in each type of plan:

The shift from defined benefit (DB) plans to defined contribution (DC) plans has been a significant trend in the U.S. private sector over the past few decades. Here’s an overview of this transition, including current participation and account balance data

The number of active participants in private pension plans has changed dramatically:

- DB plan participation declined from 26 million to 12 million

- DC plan participation grew from 36 million to 85 million

courtesy of: Georgetown university, link here >>

As of March 2023, only 15% of private industry workers had access to a DB plan.

Historical Trends

1980-2008: DB plan participation in private sector fell from 38% to 20%

1990-2018: DB plan assets: $933 billion to $1.8 trillion | DC plan assets: $579 billion to $4.5 trillion

Current Participation and Account Balances

While exact current figures for 401(k) and 403(b) plans are not provided in the search results, we can infer from the trends:

Why the Shift?

- Cost Savings for Employers: Defined benefit plans are expensive to maintain, as employers bear the investment and longevity risk. 401(k)s shift these risks to employees.

- Regulatory Changes: with Corporate lobbying more favor is to Defined contributions plans like 401k

- Increased Mobility: 401(k)s are portable, allowing employees to take their savings with them when changing jobs.

- Economic Shifts: Employees moving away from manufacturing to services, changing jobs more often

- Tax Advantages: 401(k) plans offer tax-deferred or tax-free growth, depending on whether they are traditional or Roth accounts.

- Impact to Funding: Financial Crises like 2008/2009 and Covid impacting returns and DB plans funding.

Current Trends in Retirement Savings

- Technology Integration: The rise of financial technology has transformed how people save for retirement. Automated investment platforms, robo-advisors, and mobile apps make managing 401(k) accounts easier than ever.

- Personalized Investment Options: More employers are offering target-date funds and other investment choices tailored to employees’ retirement timelines.

- Increased Longevity: As life expectancy rises, retirement savings must last longer. This has led to a greater emphasis on planning for decades of retirement income.

- Legislative Changes: Recent laws, such as the SECURE Act, aim to expand access to retirement plans and encourage savings.

The Future of Retirement Savings

Looking ahead, retirement savings are likely to evolve further as technology continues to shape the financial landscape. Key developments may include:

- AI-Driven Financial Planning: Artificial intelligence could provide more accurate and personalized retirement advice.

- Blockchain-Based Retirement Accounts: Blockchain technology may enhance transparency and security for retirement savings.

- Longevity-Focused Products: New financial products designed for extended retirement periods, such as annuities with longer payout periods, could gain popularity.

Key Takeaways

The 401(k) has revolutionized retirement savings in the U.S., offering employees greater control over their financial futures. However, this shift also places more responsibility on individuals to save and invest wisely.

At 401k Bull, we’re committed to helping you navigate these changes and make informed decisions about your retirement.

Contact us today to learn more about how you can maximize your retirement savings and prepare for a secure financial future.