It’s the dream: reaching retirement with over $1 million in your 401(k) account, ready to live comfortably for years to come. With the right strategy, becoming a 401(k) millionaire is absolutely achievable—especially if you start early and stay consistent. Here’s how to do it.

The Millionaire Milestone: Are You On Track?

According to a recent report by Fidelity, more than 544,000 401(k) participants have crossed the $1 million mark, and that number continues to rise. With over 24 million people participating in 401(k) plans, the chance of becoming a 401(k) millionaire is real—provided you follow the right steps.

Know Your 401(k) Limits

Before you start calculating how much you need to invest, it’s crucial to understand the contribution limits that govern your 401(k).

For 2025, the IRS allows you to contribute up to $23,500 annually into your 401(k), and that doesn’t include employer contributions.

For many plans, employers match contributions, adding even more to your retirement savings.

As an example, if your employer offers a match of up to $3,000, you could be contributing up to $26,500 per year.

How Much Do You Need to Invest to Become a 401(k) Millionaire?

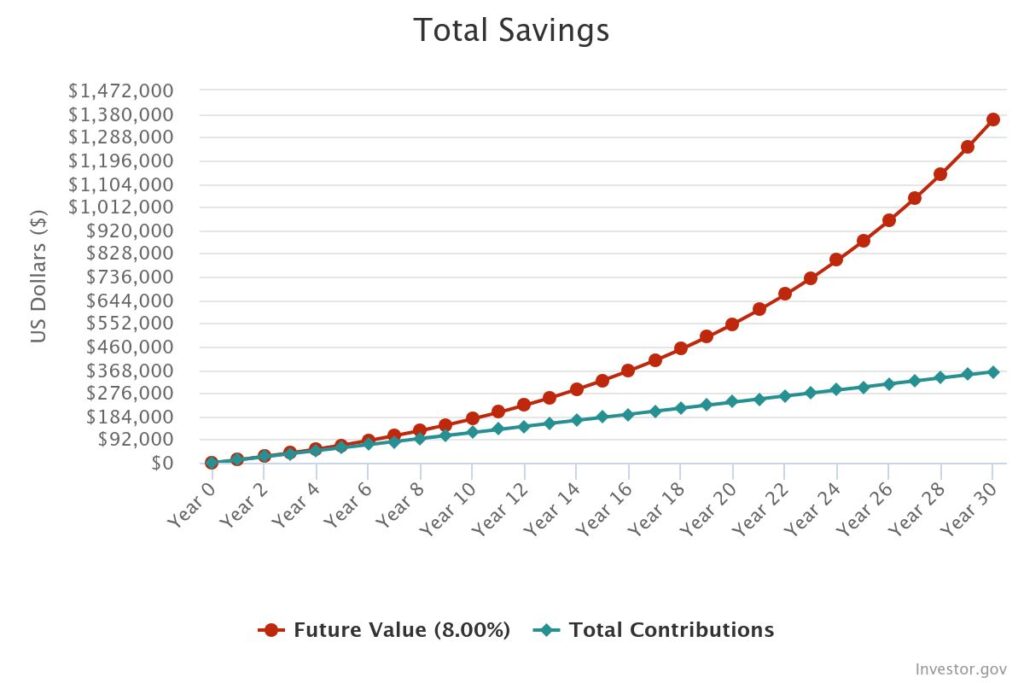

Let’s break it down. For the sake of this example, we’ll consider a 35-year-old employee who plans to save for 30 years with an initial monthly contribution of $1,000. Assuming the employee invests in a target date growth fund (which typically invests in a mix of stock market index funds like the S&P 500) and earns an average 8% annual return, here’s how the numbers add up.

The Investment Breakdown: Let’s Do the Math

- Contribution: $1,000 per month ( $500 per pay period every other week )

- Annual Return: 8% per year

- Investment Period: 30 years

Now, let’s do the math: by sticking to this plan and consistently investing, that initial $1,000 monthly contribution (plus the employer’s match) will grow significantly over the course of three decades.

Using an 8% average annual return, your savings will grow substantially, and you will end up with well over $1 million in your 401(k) by the time you’re ready to retire.

In 30 years, you will have $1,359,398.53

The chart below shows an estimate of how much your initial savings will grow over time, according to the interest rate and compounding schedule you specified.

Please remember that slight adjustments in any of those variables can affect the outcome.

See accumulation table below and check this calculator and try it out at SEC.gov , see here >>

Staying on Track: The Power of Compound Interest

The real magic happens through compound interest, which is the process where the money you make from interest or returns itself earns more money. This compounding effect allows your savings to grow exponentially over time. The earlier you start, the more time you have to let compound interest work its magic, which is why starting in your 30s is ideal.

Why Investing in Stock Funds Works

By investing in funds tied to the stock market (like the S&P 500), you’re putting your money in a growth-oriented, long-term strategy. While stocks can be volatile in the short term, historically, they’ve averaged 8% to 10% annual returns over the long term, making them one of the best vehicles for growing wealth.

Maximize Your Savings with Employer Contributions

Don’t leave money on the table. If your employer offers a 401(k) match, be sure to contribute at least enough to take full advantage of it. For example, if your employer offers a 50% match on your contributions, contributing the maximum amount of $23,500 means your employer will add an additional $11,750 (50% of $23,500). That’s free money you don’t want to miss out on.

The Takeaway: Consistency + Strategy = Success

Becoming a 401(k) millionaire is within your reach if you start with a solid strategy and stay consistent over time. Contribute the maximum amount, take advantage of employer matches, and invest wisely in growth funds like the S&P 500. The earlier you start, the more you’ll benefit from compound interest, and the closer you’ll get to your $1 million goal.

In the end, turning your 401(k) into a million-dollar retirement account requires discipline, patience, and time—but it’s more than possible.

So, start today, and watch your future wealth grow!

———————————————————————–

| Years | Future Value (8.00%) | Total Contributions |

|---|---|---|

| Year 0 | $0.00 | $0.00 |

| Year 1 | $12,000.00 | $12,000.00 |

| Year 2 | $24,960.00 | $24,000.00 |

| Year 3 | $38,956.80 | $36,000.00 |

| Year 4 | $54,073.34 | $48,000.00 |

| Year 5 | $70,399.21 | $60,000.00 |

| Year 6 | $88,031.15 | $72,000.00 |

| Year 7 | $107,073.64 | $84,000.00 |

| Year 8 | $127,639.53 | $96,000.00 |

| Year 9 | $149,850.69 | $108,000.00 |

| Year 10 | $173,838.75 | $120,000.00 |

| Year 11 | $199,745.85 | $132,000.00 |

| Year 12 | $227,725.52 | $144,000.00 |

| Year 13 | $257,943.56 | $156,000.00 |

| Year 14 | $290,579.04 | $168,000.00 |

| Year 15 | $325,825.37 | $180,000.00 |

| Year 16 | $363,891.40 | $192,000.00 |

| Year 17 | $405,002.71 | $204,000.00 |

| Year 18 | $449,402.92 | $216,000.00 |

| Year 19 | $497,355.16 | $228,000.00 |

| Year 20 | $549,143.57 | $240,000.00 |

| Year 21 | $605,075.06 | $252,000.00 |

| Year 22 | $665,481.06 | $264,000.00 |

| Year 23 | $730,719.55 | $276,000.00 |

| Year 24 | $801,177.11 | $288,000.00 |

| Year 25 | $877,271.28 | $300,000.00 |

| Year 26 | $959,452.98 | $312,000.00 |

| Year 27 | $1,048,209.22 | $324,000.00 |

| Year 28 | $1,144,065.96 | $336,000.00 |

| Year 29 | $1,247,591.23 | $348,000.00 |

| Year 30 | $1,359,398.53 | $360,000.00 |