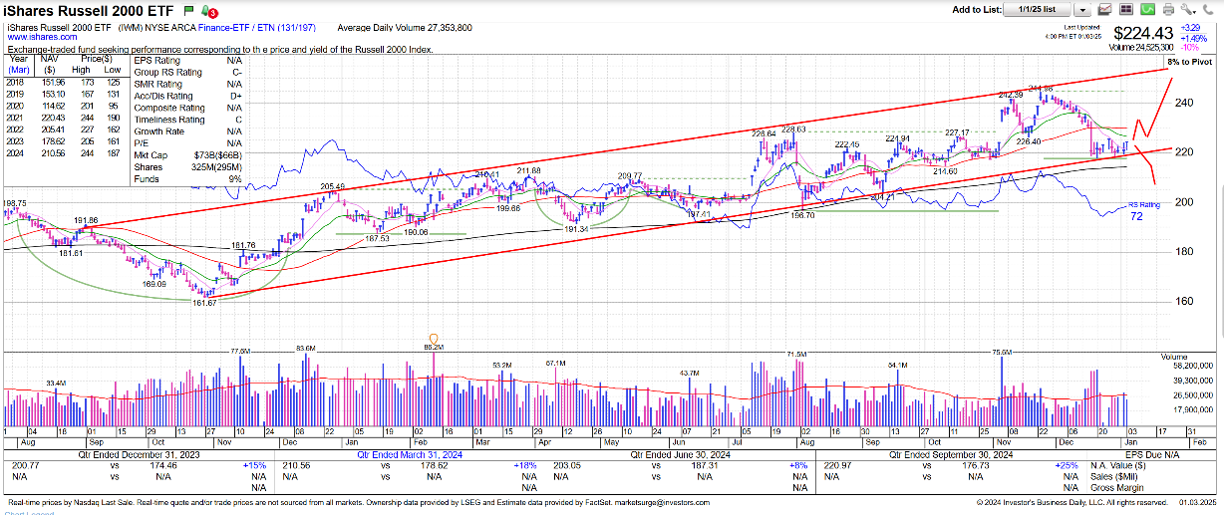

The Russell 2000 index, a key benchmark for small-cap stocks, is currently facing significant challenges. As of January 10, 2025, the index has fallen by 1.9%, bringing it down more than 10% from its all-time high of 2442.74 points reached in November 2021, and indicating that it is nearing correction territory.

Reasons for the Decline

- Economic Data Impact: The recent job growth data showed an unexpected acceleration in December, with the unemployment rate dropping to 4.1%. This robust labor market report has led traders to adjust their expectations regarding interest rates, now anticipating that the Federal Reserve may delay rate cuts until at least June 2025

- Interest Rate Sensitivity: Small-cap stocks are particularly sensitive to interest rate changes. The Fed’s more hawkish stance and the fading hopes for imminent rate cuts have contributed to a sell-off in the Russell 2000, as investors reassess the economic outlook and its implications for borrowing costs

- Market Sentiment Shift: There has been a notable shift in market sentiment as large-cap tech stocks have outperformed small caps. In contrast to a 23% rise in the S&P 500 during 2024, the Russell 2000 only managed a 12% increase, reflecting broader investor preferences

Positioning for 2025

Looking ahead to 2025, there are several strategies investors might consider for positioning in small-cap stocks:

- Valuation Opportunities: The current valuation gap between small-cap and large-cap stocks is significant, with small caps trading at lower price-to-earnings ratios compared to their larger counterparts. Historically, when such discrepancies occur, small caps tend to outperform over the following years.

- Long-Term Growth Potential: Despite short-term volatility, many analysts believe that small-cap stocks could offer strong total returns over the long term due to their potential for growth in a recovering economy.

- Diversification Strategy: Incorporating small-cap stocks into a diversified portfolio can help mitigate risks associated with overexposure to large-cap stocks or specific sectors like technology.

In summary, while the Russell 2000 is currently experiencing downward pressure due to economic data and interest rate concerns, investors may find opportunities by focusing on long-term growth potential and valuation discrepancies as they position themselves for 2025.