Managing Company Stock in Your 401(k) Plan

Understanding Company Stock in Your 401(k) Plan

If you work for a publicly traded company, you may have the option to hold company stock within your 401(k) plan. Many companies offer stock grants, restricted stock units (RSUs), or allow employees to purchase company shares at a discount as part of their retirement benefits. Managing this stock effectively is crucial for balancing risk and optimizing long-term financial gains.

Over the years, fewer employees have been keeping large amounts of company stock in their 401(k) plans—but this shift came after hard lessons were learned. One of the most well-known cases was Enron’s collapse in 2002. Before the bankruptcy, 62% of the assets in Enron employees’ 401(k) plans were invested in Enron stock. When the company went under, many employees not only lost their jobs but also saw their retirement savings disappear.

Despite these past disasters, many employees today still hold a significant portion of their 401(k) in company stock. While it may feel like a good investment in a company you believe in, relying too heavily on a single stock in your retirement plan can be risky. Diversification—spreading investments across different assets—can help protect your savings from unexpected downturns.

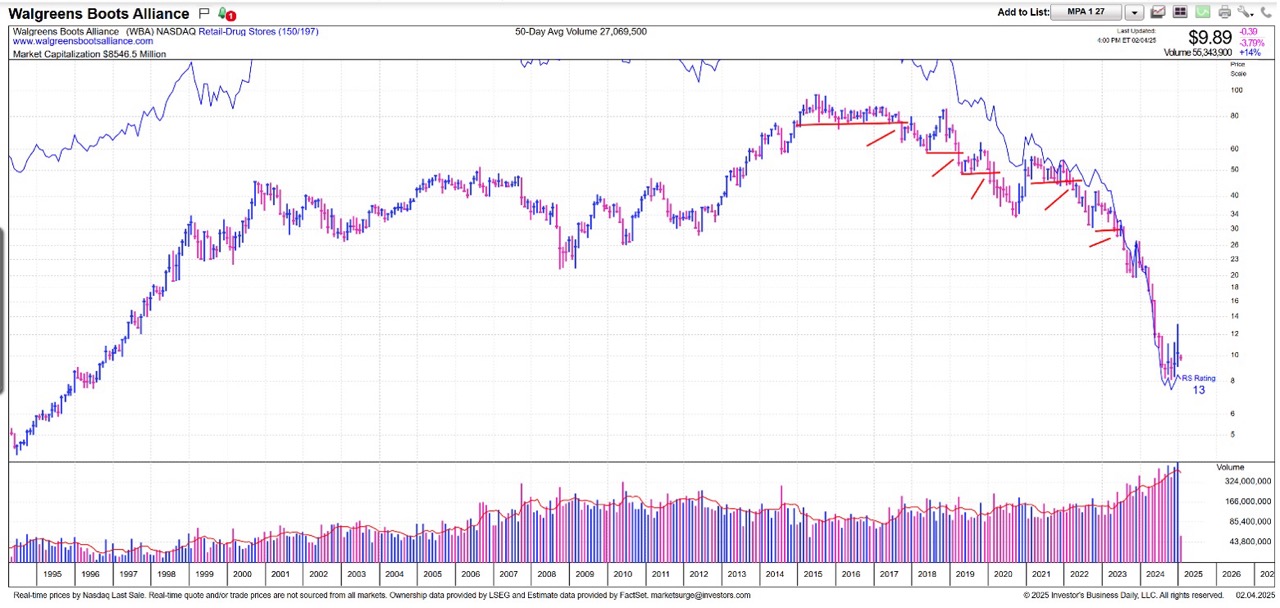

Sample Case: Walgreens WBA

Over the past decade, Walgreens Boots Alliance (WBA) has experienced a significant decline in stock value. On August 5, 2015, WBA’s stock reached an all-time high closing price of $66.46. As of February 4, 2025, the stock closed at $9.76, representing a decline of approximately 85%. macrotrends.net

Employees who held substantial amounts of WBA stock in their 401(k) retirement plans have faced considerable losses due to this downturn. For instance, an employee with $10,000 invested in WBA stock in 2015 would see that investment reduced to about $1,465 by 2025.

Chart indicates several exit points that are violating Technical chart of the WBA stock where employee could sell portions or entire holding.

What Are RSUs and Stock Grants?

Restricted Stock Units (RSUs) and Stock Grants are forms of compensation that companies provide to employees as an incentive for long-term employment and performance. Here’s how they work:

- RSUs: These are awarded to employees but do not become theirs until they vest over a specific period. Once vested, the shares are typically transferred into an investment account.

- Stock Grants: These can be outright gifts of stock or stock options that allow employees to purchase shares at a predetermined price.

How Do Shares Vest and Enter Your Investment Account?

Most companies have a vesting schedule that determines when employees gain full ownership of RSUs or stock grants. Vesting schedules often follow these patterns:

- Cliff Vesting: 100% of the stock vests after a set number of years. Like 3-5 years.

- Graded Vesting: A percentage of shares vest each year until fully vested. Ei 20% vests every year over 5 year period. Once vested, stocks can be transferred into your 401(k) or another investment account, depending on the company’s policy.

Managing a Concentrated Stock Position

Holding too much company stock can be risky. If a large portion of your retirement savings is tied to one stock, you may face significant losses if the stock price declines. Strategies to manage concentrated stock positions include:

- Diversification: Reallocate assets to reduce reliance on company stock.

- Selling Over Time: Gradually selling stock to spread out tax implications.

- Options Hedging: Using financial instruments to manage downside risk.

- Stop-Loss Strategies: Setting predefined price points to sell shares before significant losses occur.

Tracking Your RSUs and Grants

Proper tracking of RSU vesting dates, stock grants, and company contributions is essential to maximize benefits and minimize tax liabilities. Employees should:

- Regularly review their vesting schedule.

- Monitor stock performance.

- Assess tax implications before selling shares.

Understanding Net Unrealized Appreciation (NUA)

Net Unrealized Appreciation (NUA) is a tax strategy that allows employees to transfer company stock from a 401(k) into a taxable brokerage account at a lower tax rate. The benefit of NUA includes:

- Lower Capital Gains Tax: Instead of paying ordinary income tax, employees can pay the long-term capital gains rate on stock appreciation.

- Tax Deferral: Taxes on appreciation beyond the cost basis are deferred until the shares are sold.

- Estate Planning Benefits: Heirs can receive a step-up in basis if the stock is inherited.

What Happens to Company Stock When You Leave the Company?

Employees leaving their company have several options for managing their company stock:

- Rolling Over to an IRA: Retain tax advantages while diversifying investments.

- NUA Distribution: If eligible, use NUA for potential tax savings.

- Selling the Stock: Convert shares to cash and reinvest in a diversified portfolio.

Important Questions to Ask

When managing company stock, employees should consider asking:

- What percentage of my portfolio is in company stock?

- How does my company’s stock fit into my overall retirement plan?

- What are the tax implications of selling my vested shares?

- How do I hedge against a decline in company stock value?

- Should I roll over company stock when I leave the company?

Another Case Study: The Risk of Holding Too Much Company Stock

Consider the example of Enron, where employees heavily invested in company stock lost a significant portion of their retirement savings when the company collapsed. Proper risk management, such as diversification and stop-loss strategies, could have prevented severe losses.

Take Control of Your 401(k) Stock Investments

Managing company stock in your 401(k) requires strategic planning to balance growth and risk. If you want to learn how to protect and optimize your company stock investments, request a free consultation with our licensed professionals today!

It’s important to note that holding a significant portion of company stock in your retirement portfolio can expose you to increased risk due to lack of diversification. Financial advisors often recommend diversifying your investments to mitigate potential losses associated with a concentrated stock position.

For personalized advice on managing your 401(k) allocations, including decisions about company stock, consider consulting with a financial advisor who can provide guidance tailored to your individual financial situation.

Remember, successful investing is a journey of continuous learning. At 401k Bull, – we’re empowering you with the knowledge and tools to become a more confident, skilled investor.

Join us today and take control of your financial future!Related Videos

- Latest market analysis and review

- Current market signals for 401k funds and ETFs

- Latest Stock ideas

- Latest Funds and ETF’s Ideas