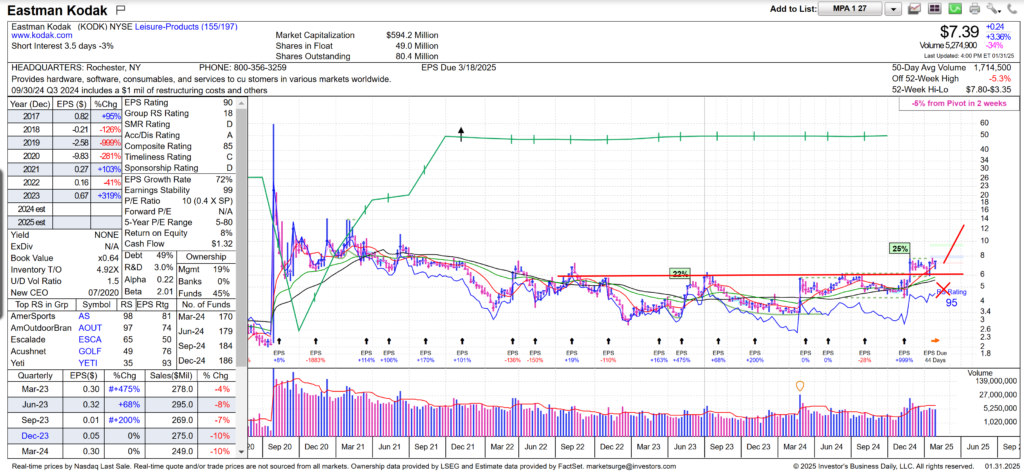

Chart Above

– left intraday chart on 30min bars – red line is 5 day moving average line increasing, buy alert at $6.99 or better, close above $7.7 would confirm uptrend,

– right medium term with daily bars – green line 21 day increasing, red 50 day moving average line increasing, blue 200 day line increasing both indicating long term uptrend, and price consolidating over time the January.

President Trump announced a $765 million federal loan to Eastman Kodak to help the company enter the pharmaceutical industry and produce ingredients for generic drugs, including hydroxychloroquine. This announcement was part of an effort to bring pharmaceutical manufacturing back to the United States.The news caused Kodak’s stock to soar by almost 2,000% in the short term. However, the loan never materialized as it turned out to be only a “letter of interest” rather than a finalized deal. The botched loan attempt led to scrutiny and criticism of both the government and Kodak.

Since then, Kodak has been working to stabilize its business:

- In 2020, Kodak reported consolidated revenues of $1 billion and ended the year with a cash balance of $196 million.

- The company has been focusing on its core businesses in print and advanced materials & chemicals, including manufacturing pharmaceutical ingredients1.

- Recently, on December 31, 2024, Kodak’s Retirement Income Plan Trust completed a significant asset sale, receiving $540.6 million in proceeds from selling assets to Mastercard Foundation.

- There are positive signs of insider confidence, with multiple insiders buying Kodak stock recently. Two insiders invested US$109k in company shares, indicating some optimism about Kodak’s future.

As of January 31, 2025, Kodak’s stock price increased by 4.7%, suggesting some renewed interest in the company. However, the stock is still far from its 2020 highs, indicating a period of consolidation as the company continues to reshape its business strategy and financial position.

Technical Set up

Buy Point: would be great to pull back first to $7 and then get going so we can place stop at $6.60

Risk : – 5.4%

Reward: Higher, next supply is at $14 (100% higher)

Daily Chart

All moving averages are increasing, green 21 day, red 50 day, and black 200 day

Latest earnings are showing strong increase to 0.15c/share vs estimates

$6 technical resistance is broken on huge volume is holding it.

Relative market strength is way improved to 95 (better performance over 1 yr than 95% of the stocks)

Had a nice pull pack in Jan 2025 to 50-day line and nicely bounced on above daily Chart

Was up 4.97% on Friday 1/31 when market was doing really bad so not much corelated to it

Weekly Chart below looks great with 3yr consolidation and breaking out $6 resistance

PE ( price to earnings) is only 10 while overall market PE is at 25.

Weekly Chart below

Earnings Review

Eastman Kodak’s latest reported earnings were for the third quarter of 2024, released on November 12, 2024. Here are the key highlights:

- Revenue: $261 million, a decrease of 3% compared to Q3 2023

- Gross profit: $45 million, down 10% from the same period last year

- Gross profit percentage: 17%, a decrease of 2 percentage points from Q3 2023

- GAAP net income: $18 million, a significant increase of 800% compared to $2 million in Q3 2023

- Operational EBITDA: $1 million, a substantial decrease of 92% from $12 million in Q3 2023

- Earnings per share (EPS): $0.15, beating estimates by $0.15

- Cash balance: $214 million as of the quarter-end, down from $255 million at the end of 2023

The company’s performance shows mixed results, with declining revenue and gross profit, but a significant increase in net income. The stock price reacted negatively to the earnings release, dropping 16.55% the day after the announcement but recovered shortly after that on 11/25 had 18% run with 860% volume increase.

Kodak’s next earnings release is estimated to be on March 13, 2025, which will cover the fourth quarter of 2024

Related Articles

- Positive Signs As Multiple Insiders Buy Eastman Kodak Stock -January 29, 2025

- Earnings Review Nov 14 2024

- Column: Trump taps Kodak to bring stability to the drug market By David Lazarus, July 30, 2020

Related Videos