The SPY, which represents the S&P 500 index, demonstrated resilience today despite market pressures. As of the close, SPY finished at $599.37, showing strength in the final 30 minutes of trading. This late-day buying interest pushed the index to close near the top of its daily trading range, indicating some investor optimism.

For 401(k) holders, it’s important to remember that the SPY represents a broad market index. While daily fluctuations can be nerve-wracking, long-term investors should focus on their overall financial plan rather than short-term market movements. If you’re concerned about your 401(k) allocation, consider speaking with your plan administrator or a financial advisor to ensure your portfolio aligns with your risk tolerance and long-term goals.

Technical Analysis

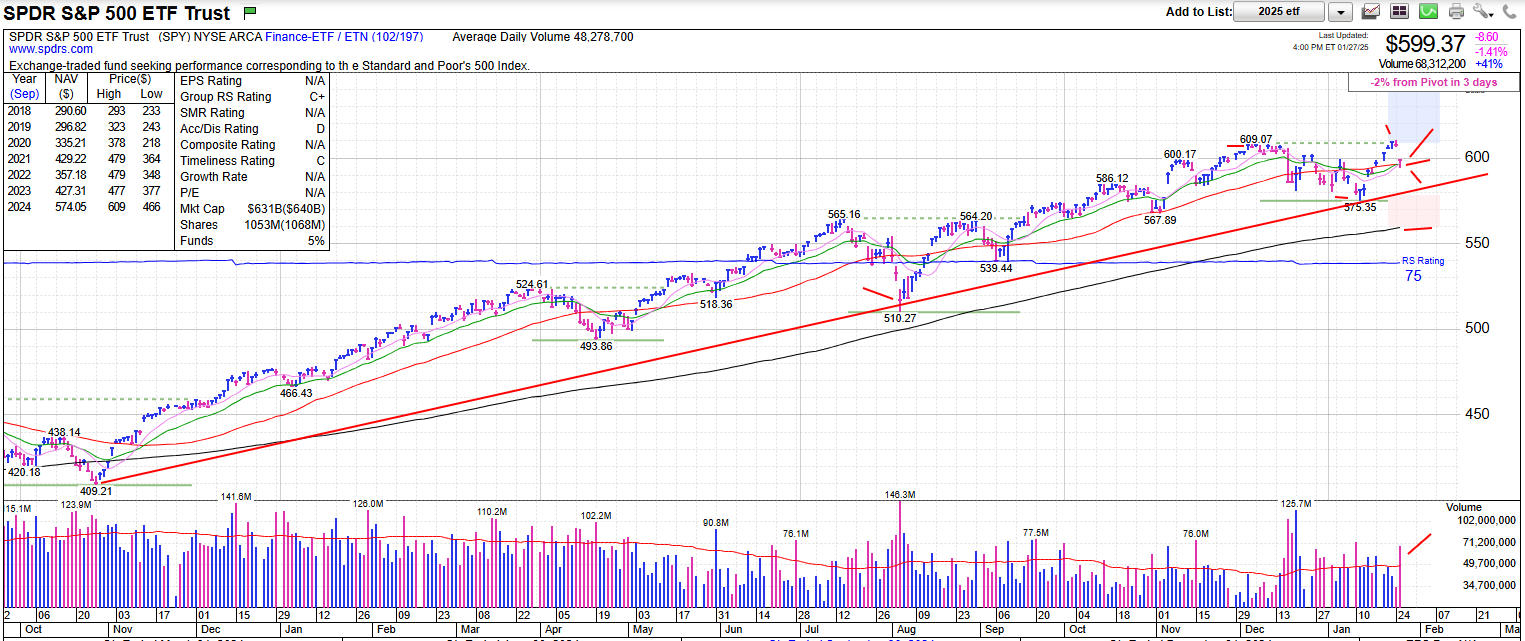

The SPY is currently holding key technical levels: moving averages are crucial support levels that many investors watch closely. The fact that SPY is trading above both the 50-day and 200-day moving averages is generally considered a bullish signal.

Support Levels

- January 13, 2025 level: $575 (strong support)

- 200-day moving average: $545 (approximately 7% below current levels)

If SPY closes below $575, it could potentially test the 200-day moving average at $545. This would represent a significant correction and might cause concern for 401(k) holders.

Today’s Trading

The largest sell-off today occurred in the morning hours, with the SPY touching a low of $594.67.

However, buyers stepped in during the afternoon, particularly in the last 30 minutes, to push the price higher.

Investor Expectations

Many investors are cautiously optimistic but remain alert to potential volatility. Some key points:

- The market has shown resilience, bouncing off intraday lows.

- There’s ongoing concern about economic indicators and corporate earnings.

- Investors are closely watching Federal Reserve policy for any shifts that could impact equities.